Much writing has been done on the current nature of the property market these days. A general trend is the sentiment that property price corrections will occur, resulting in home prices falling by 10%-15% by 2014. Comparing private housing sales in January to the year just before, there is a fall of 72.1% or 565 units sold, down from the previous 2,028 units sold in Jan 2013 (source: Reuters news). If this drop continues over the next few months, the resulting drought will no doubt put some pressure on property prices.

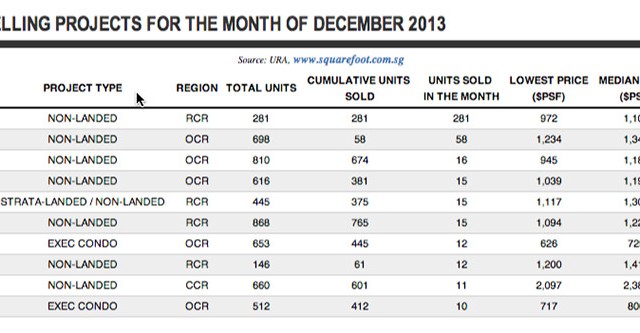

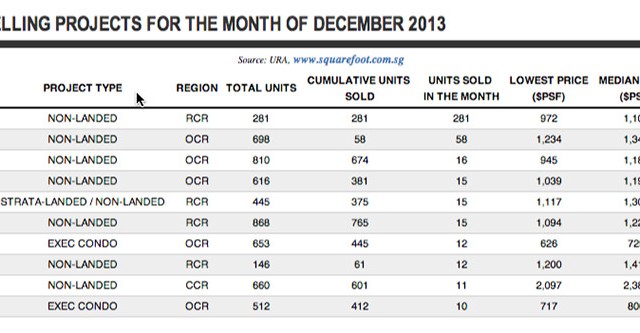

It’’s not all bad news however. Amongst the certainty of the current climate, we are happy to state that many projects that were launched in 2013 have seen good results. These include the Hilford (a retirement resort with 60 years tenure) and The Inflora. These were both sold out within a few days of being launched (Table 1), truly an impressive feat indeed! And they aren’t the only ones, as Skyvue, Duo Residences, Thomson Three and Bartley Ride have achieved most of their units sold and received a generally great response from the public!

Why were both Hilford an Inflora so popular? Let’s do a post-analysis and figure out the mystery.

First off, let’s look at what these two projects share. At a low price of below $1000psf and a lower quantum, both projects are very good value for money. 67% of Inflora’s 396 units comprises of 2-bedder or below, priced below $800k. Hilford’s 281 units are all 2-bedder and below, also priced below $800k

Now what about the differences? Inflora’s location is at Flora Drive and notably, it is not close to any MRT station limiting its accessibility. Hilford’s strategic location near Upper Bukit Timah road allows it access to the future Beauty World down Town MRT Line.

Both properties also serve different purposes. Hilford is the first retirement resort in Singapore in its niche and only has 60 years of lease, which is why the psf is below $1000. Like the majority of Kensington Square’s Freehold units, Duo Residences and Riverbanks@Fernvale were built with many more 1 and 2-bedder units. These smaller size units allowed them to keep the quantum low, and otherwise more affordable for the general public.

Taking the above in account, we predict a rising trend as developers aim for cosier projects with smaller sized units. The overall quantum will thus be lowered to $1 million or below, keeping the price for most units attractive for more home investors.

From the above reference, we might be seeing a shift in positioning by developers by building more projects with smaller sized units and thus, lowering the overall quantum to $1 million or below for most units and keeping the price attractive for home buyers.

Table 1: TOP 10 Best Selling Projects for the Month of December 2013