“Has property price peaked?”

“Is it still trending?”

“Or is it on a downward slope?”

These are some of the many questions that many home investors grit their teeth and wish for the gift of omniscience. Unfortunately, there are no magic rituals to tell the future, but luckily it’s not all wild mass guessing – statistics and historical trends provides us with the info that we need.

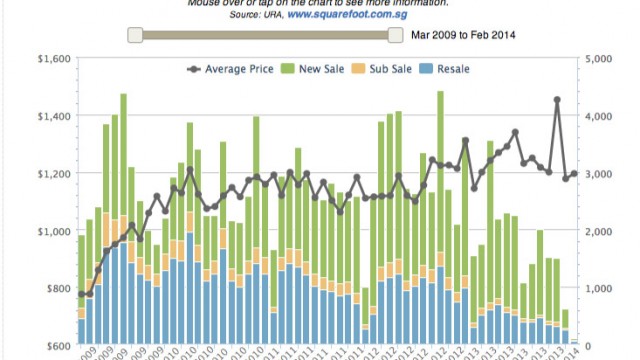

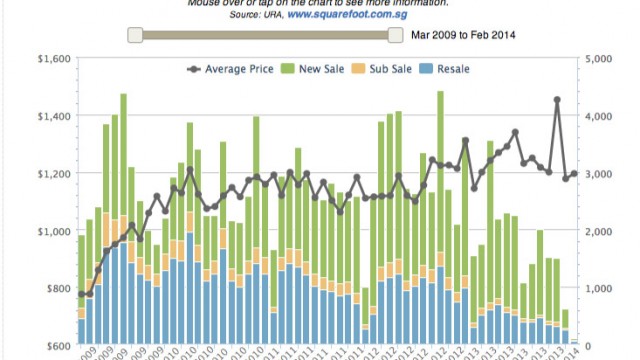

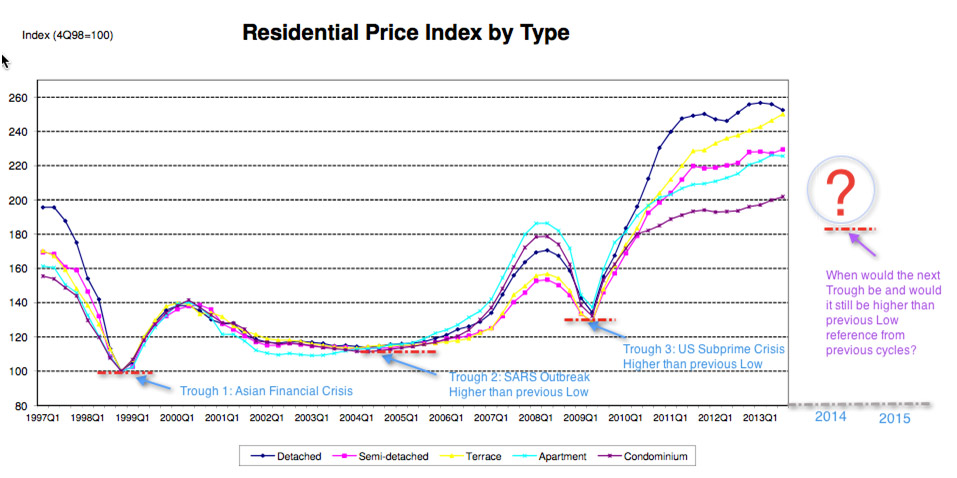

Table 1 displays previous property cycles in Singapore. From this, we can see that in order for a drought to occur, some triggering factors such as a significant event has to persist over a period of time. Singapore property prices has sadly been on a rough patch since the 2nd half of 2009, taking a massive drop from $3000psf to $800psf when the median prices of all districts is concerned!

Strangely enough, while property pricings are still going up, transaction volumes have been on the onwards path since Mid-2013 (Table 3). This is easily explained with history of the time period: the 7th wave of cooling measures consisting of higher additional buyer stamp duty (ABSD) and a more stringent mortgage loan curbs (loan-to-value) had just been put into implementation on all purchasers!

Right after, the government introduced the Total Debt Servicing Ratio (TDSR). Unlike cooling measures, these are permanent due to being structural in nature, but can be lifted if property prices fall too much during a slow down. In addition, the government has the right to fine-tune their 60% ratio as they see fit.

With this knowledge in hand, let’s look ahead to the future: will property prices continue to be push down, or will it stabilize over a long period of time? Most likely, the property prices will be affected by the demand for residential units and natural law of supply and demand, assuming no major disaster takes place in the meantime.

To get to this conclusion, one must first understand the purpose of property cooling measures. These are meant either to “prevent prices from skyrocketing forming a huge property bubble” or “to ease home prices in a gradual manner”, not to sharply correct and drop property prices for its own sake. These are the words of Minister Khaw Boon Wan himself. To put this into context, consider the Lehman Brothers crisis, where a sudden price correction led to widespread adverse effects on our finance institutions, businesses, housing and general economy. In this light, cooling measures reel in an overload of passion and emotional outbursts, allowing investors to be more prudent when making important purchases such as property.

TSDR’s introduction in July 2013 throws a wide net over every aspect of financial prudence when mortgage loans availability is concerned. It takes a holistic look at the overall finances of an individual, taking into account his outstanding debts.

With lesser property investors able to securing a longer loan tenure or utilize a higher loan quantum, obviously property transaction volumes will go down, however, this is actually good for genuine investors as property developers for new launches will now price more realistically and in-line with current market sentiments. In fact, we are already seeing some make the proper price adjustments for their new launches.