“To Buy or Not to Buy”, that is the question many investors have asked themselves over the ages. As an investment choice, property assets in Singapore are blessed with several advantages: An AAA-rated economy, stability compared to other SE Asian Countries and strong growth potential. Such attractive features attract even global investors, which wish to either leverage on Singapore’s rapid growth or hedge against inflation by investing in its real estate sector. Whatever their reasons, the end result is the same: A potential increase in capital appreciation over time.

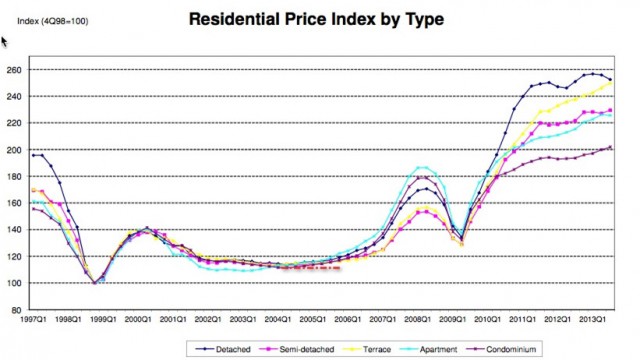

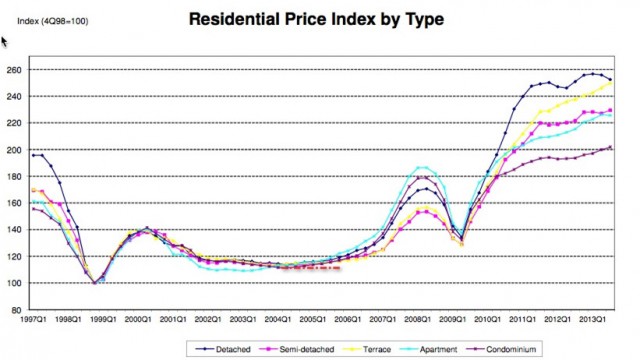

The following Table 1 shows a trend in every property type. In it, we can quite likely conclude that there is a strong link between Singapore’s sound economy, its pro-business environment and rising value of property prices. Though this is a historical chart, in modern times we can see that even the low points of today’s property market is still higher than the lows of previous age..

Logically speaking, if one’s aim is to turn a profit from the property market so as to achieve a financial success, one has to own a handful of properties, rather that just one. Break down the reasoning: If you only have one property, then it is highly likely that you are staying in it for your personal life. Therefore, it is not earning you any money because you are unable to utilize it for rent. The alternative course of action in this case – cashing out, does not work as even if you sold your current property at a higher price, you would still need to buy another at a similar price range in order to replace the house that you live in.

Now let’s consider what happens if you have multiple properties to spare. In leaner years, you can utilize renting out your properties to others, whose income will help to fulfill your upkeep costs such as mortgage payment and help service the interest rates. However, when the market is red hot, you can then considering cashing out at no harm to yourself or even taking up an equity loans to pursue other investments!

Regarding interest rates, it is much more beneficial to maximize the loan tenure years while bank interest rate is low. As Singapore’s inflation rate has been measured to be around 3.5% to 5% over the past years, getting a mortgage loan of below 2% offers fantastic savings to offset the inflation rate. Home owners could consider refinancing every few years to keep their interest rates down.

Everything just said sounds so good – but then why are some homeowners still hesitant?

The greatest fear of many prospective home buyer is the fear that they may have brought their property at the wrong time. Prices rise and fall, but the period in which a property is at its most valuable and has no way other to go than downwards is known as the “peak.” Newbies, with their lack of knowledge, always fear that they might have made a mistake buying a property at its peak, where it will eventually drop or collapse as time goes on. Therefore, they are always “waiting for the perfect moment”, but as there is no time good enough to be “perfect” for them, they will never end up making any purchases.

Another common fear is information overload – with a wide variety of new launches coming out rapidly, inexperienced buyers may be overwhelmed and confused by the amount of choices he has – you can’t just buy any property, but one that fits your desired needs. However, the only cure for this lack of knowledge is experience – newbies should take the time to simply visit more show flats to study them. By gaining experience with the characters of individual projects, prospective home buyers will eventually figure out what they need in terms of property.

Not to say that experienced homeowners are free from problems. For those who already own properties for the purpose of rental, oversupply is a constant concern. This can be caused by projects being awarded with a T.O.P (temporary occupation permit). Otherwise, he could be worried about not being able to service mortgage payments due to unexpected events, such as increases in the mortgage interest rate or even a crisis.

In addition, several regulations have gone into effect that has made sweeping changes in the environment. The holding period for imposition of SSD on residential properties has been extended from 3 to 4 years, based on new rates announced on 13 Jan 2011. This change has put an end to a huge sub-sale market and those looking to quickly cash out before a project’s T.O.P date will be hit with a seller’s stamp study.

Finally, home buyers are receiving a huge hit to their wallets due to changes. Loan-to-value for a second home purchase is capped at 50%, meaning home buyers have to come up with 50% of down payment along the ABSD. e.g A non-landed residential purchase price of $1,000k means a down payment of more than $500k after including stamp duties and other fees. This will affect any homeowner seeking to acquire more than one property, cooling off the high demand for asset class purchase.

So why make a first or second purchase now?

Judging the right time to enter the market for a purchase is never an easy task. As a wise property investor friend of mine says: “Don’t try to enter the property market to decide what’s the best time to jump in is. Rather, look at your own finances and figure out whether you can ride the wave long enough to coast through any difficult time that arises, until you can turn it as a profit.” As she is someone who has owned several properties, both local and overseas, I am inclined to take her word for it.

For homeowners who already have a first asset, considering obtaining, under advisement from an experienced bank, an equity mortgage (reverse mortgage) for another investment. Whether you invest in industrial properties which will not be subjected to ABSD or SSD or just a simple mixed development, it will surely pay off in the long run.

Be warned, the government does not sit idly by content to rest on their laurels. With their eagle eyes, they swoop in and act swiftly to prevent massive price corrections before they occur. While this might be frustrating for those seeking to build a fortune, it is for the greater good as their property cooling measures are used to curb speculative demands during a prosperous economy that can lead into a death spiral of collapse. However, they are not perfect, and thus sometimes the property prices may be adjusted too much than what was anticipated. In such cases, these measures will generally be fine-tuned to their correct levels over time.

To sum it up, one’s purchasing power relies on one’s financial health and budget. There is no one single answer to what is the “right time” to buy. Even in the realm of which property is the best, properties with similar size could vary wildly in price depending on developer fame and district location. Indeed, many property investors are now looking at an “overall quantum value” then the standard “per square foot” (PSF) value that has been used to this day. Developers are sensing the trend: they are now launching smaller, affordable units such as 1-bedder or studios.

If you have spare cash and the will to act, you will surely be able to find the right property that meets your budget, right here, right now.